LG Chem posts 2022 management performance

2023.02.02■ Consolidated performance for 2022 (includes LG Energy Solution)

□ Revenue: KRW 51. 8649trillion (+21.8% YoY)

□ Operating profit: KRW 2.9957 trillion (-40.4% YoY)

■ 2023 revenue target: KRW 32.2 trillion (excludes LG Energy Solution)

□ Petrochemicals: low-carbonization of existing products, strengthening high value-added businesses, and fostering new sustainability business

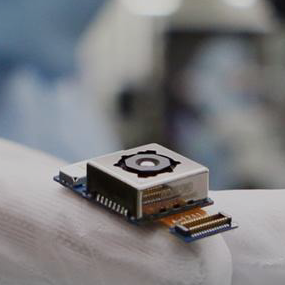

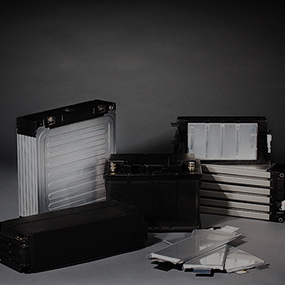

□ Advanced Materials: continued revenue growth is expected as the cathode materials shipment grew by more than 50%

□ Life Sciences: maximizing business synergy through AVEO acquisition, revenue expected to reach KRW 1.2 trillion in 2023

On the 31st, LG Chem announced that the company recorded consolidated revenue of KRW 51.8649 trillion and operating profit of KRW 2.9957 trillion. Revenue grew by +21.8% YoY, surpassing the KRW 50 trillion-mark for the first time in the company’s history. Operating profit recorded -40.4% YoY.

Despite difficult external and internal business environments throughout 2022, LG Chem announced that the company succeeded in building a stable business portfolio as its battery materials business further expanded. Additionally, the company revealed that along with an enterprise-wide revenue growth, it generated EBITDA(consolidated) of KRW 6.4 trillion.

LG Chem’s revenue last year marked KRW 30.9 trillion, excluding LG Energy Solution. The revenue target for this year is set at KRW 32.2 trillion, a 4% YoY increase.

On the company’s business outlook, LG Chem expects a challenging business environment to last from economic slowdown and high interest rates due to inflation. Despite such difficulties, the company stated that it will continue to lay the groundwork for an enterprise-wide growth trend and preparation for the future. The company’s efforts will largely be based on Petrochemicals’ low-carbonization of existing products, strengthening high value-added businesses, and fostering new sustainability business, Advanced Materials’ continued revenue increase from over 50% in cathode materials shipment, and Life Sciences’ maximization of global business synergy through AVEO acquisition(revenue expected to reach KRW 1.2 trillion in 2023).

In the meantime, LG Chem posted a consolidated revenue of KRW 13.8523 trillion and operating profit of KRW 191.3 billion in 4Q22.