LG Energy Solution Announces Fourth Quarter and FY 2021 Results

2022.02.08■ Reports quarterly revenue of KRW 4.44 trillion, 10.2 percent higher than previous quarter; operating profit at KRW 76 billion

■ Targets revenue goal of KRW19.2 trillion with plans to spend KRW 6.3 trillion in capital expenditures for 2022

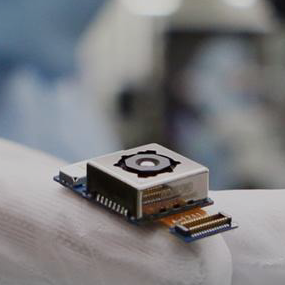

SEOUL, February 8, 2022 - LG Energy Solution (LGES; KRX: 373220) today reported solid performance in the fourth quarter of 2021, with consolidated revenue of KRW 4.44 trillion, up 10.2 percent from the previous quarter. The quarterly revenue growth was mainly driven by robust demand of pouch and cylindrical battery cells for electrical vehicles and small-sized pouch batteries for IT devices. The company posted consolidated operating profit of KRW 76 billion, since turning to profit in the fourth quarter.

For the full year, LGES reported KRW 17.85 trillion in revenue, up 42 percent from 2020. Annual operating profit was at KRW 768.5 billion while operating profit margin was 4.3 percent. The booming performance comes on the back of solid demand for electric vehicles as well as cylindrical batteries for EVs and light EVs.

The annual earnings result took multiple factors into account, including a voluntary recall with General Motors for Chevrolet Bolt EV batteries, a recall of batteries for energy storage system (ESS) and a lump-sum payment of license fee from another industry player. Were it not for these one-time factors, LG Energy Solution’s annual revenue would stand at KRW 16.86 trillion, its operating profit at KRW 917.9 billion.

In 2022, LGES expects its revenue to reach KRW 19.2 trillion, up 8 percent on-year, over expectations of steady EV market growth. Without the aforementioned one-off factor, the revenue would be 14 percent higher, on-year.

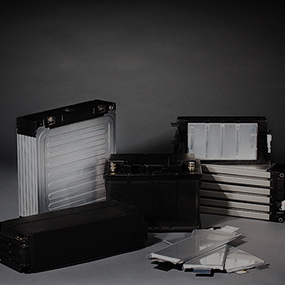

In 2022, LGES plans to steadily expand its manufacturing capacity as its major partnering automakers plan to introduce new lineups of electric vehicles. LG Energy Solution is forecasting to see an improved market condition as the global chip shortage is expected to ease in the latter half of the year.

In preparation of the upcoming boost in global EV sales, LG Energy Solution is putting KRW 6.3 trillion in capital expenditures, up 58 percent compared to last year. With it, LGES aims to finance capacity expansion at its global manufacturing facilities including JV plants with GM.

“LG Energy Solution will excel by prioritizing the fundamentals of quality and securing profitability,” said Youngsoo Kwon, CEO of LG Energy Solution. “LGES will continue to move forward with bold investment plans needed in the long run. We are confident our business model of preparing for the future will definitely help us lead the industry.”