LG Chem reports 2021 management performance

2022.02.09On January 8th, LG Chem announced that the company racked up revenue of KRW 42.7tn(+41.9% YoY) and operating profit of KRW 5.3tn(+178.4% YoY) in 2021, resulting in the highest ever annual increases in both.

In 4Q21, the company reported revenue of KRW 10.95tn(+3.2% QoQ) and operating profit of KRW 748bn(+3.0% QoQ) (+23.0% YoY for revenue, +521.1% YoY for OP)

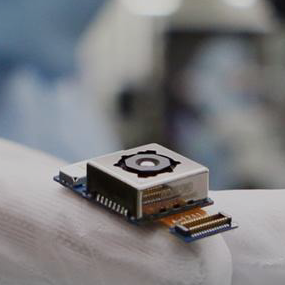

In 4Q21, profitability in the petrochemical and high-tech materials sectors fell partially compared to the previous quarter due to downward stabilization of demand for petrochemicals and supply and demand of semiconductors for vehicles, but continued sales growth despite regular maintenance of major production lines such as Daesan NCC(Naphtha Cracking Center).

Regarding 2021 reports, Dong Seok Cha, Executive Vice President and CFO of LG Chem said “Despite sudden changes in all angles of our business environment including global distribution issues, automotive chip shortages, skyrocketing raw material prices and even product recalls, LG Chem achieved a significant growth in revenues and profits across all business areas.”

Target revenue for 2022 is KRW 27tn, plans for KRW 4.1tn worth of CAPEX

LG Chem set 2022 target revenue to KRW 27tn (+4.0% YoY). This is the direct business standard of LG Chem, excluding LG Energy Solution.

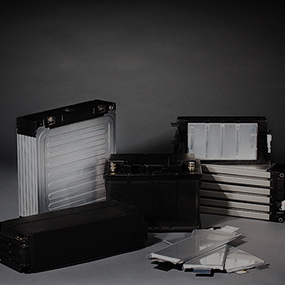

The Company set this year’s CAPEX to KRW 4.1tn (+31.8% YoY), most of which will be invested to growth drivers such as sustainability business and expanding production capabilities for battery materials business.

Mr. Cha, CFO of LG Chem stressed that “This year’s business environment will likely be tough as ever, but the company will continue to maintain its growth trends,” and highlighted the Company will “strive to maintain enterprise-wide growth engines in each of the Company’s business areas including ▲petrochemicals: strengthening high value premium business ▲advanced materials: expanding shipments of high-nickel cathode materials ▲life sciences: releasing biosimilars at a full-scale and expanding sales of aesthetics business lines in China.”